This Week in Apps - Converting Much?

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

U.S. Revenue Index (vs. 30 days ago)

Insights

1. Custom Product Pages Are the App Store's Secret Weapon

One of the most effective ways to turn views into downloads is to show users exactly what they're looking for.

On the App Store, that's where Custom Product Pages (CPPs) come in handy. Instead of a generic "here's everything my app does" listing, CPPs let you tailor your App Store page to match a specific user's intent (aka the keyword they searched for). That could be a feature, a need, or even a mood.

If you've run Apple Ads, you've had access to CPPs for a while. And if you have, you know how big of a lift pairing keywords with custom pages can deliver. But here's what makes this even more exciting: starting in iOS 26, CPPs will show up in organic search results, too.

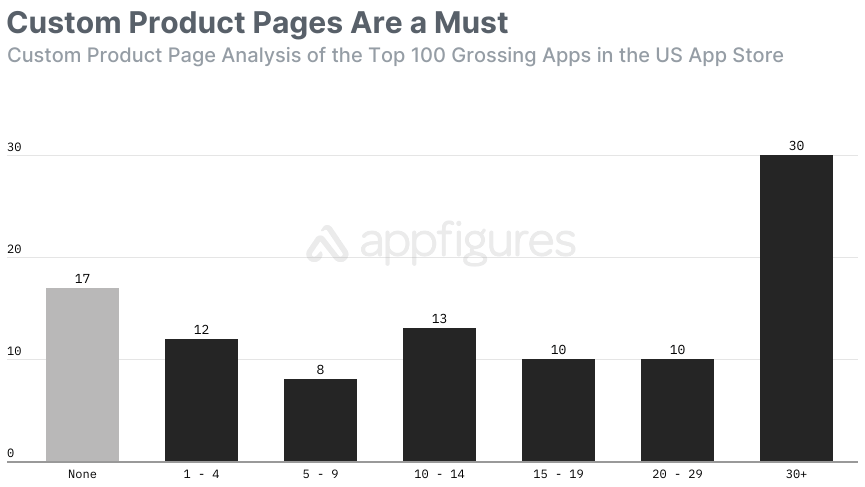

I was curious to see if the top apps are already taking advantage of CPPs so I used the newest addition to our Apple Ads Intelligence to analyze the top 100 grossing apps and games in the US App Store:

I've been talking about optimizing screenshots for a while now so I knew CPPs were popular, but didn't expect them to be this popular!

- 83 of the top 100 grossing apps and games leverage CPPs.

- 30 of those apps and games use 30 or more CPPs.

- Only 17 apps and games don't use any CPPs at all, and there's a very clear reason for that.

That's not a niche growth hack. That's mainstream adoption.

What's interesting is that most apps are either all in or not using them at all. There's a clear hump around 30+ pages, suggesting that once developers see the results they scale them aggressively.

And the pattern isn't random. Both apps and games across a variety of categories leverage CPPs.

The biggest adopters of CPPs are the apps that live and die by conversion rates. Games like Candy Crush, PUBG Mobile, and Bingo Blitz dominate the 30+ CPP group. These are massive user acquisition machines where every 1% improvement in conversion compounds quickly. Apps like Facetune, PictureThis, and FaceApp are also very active. These are feature-rich tools where each CPP highlights a specific outcome — perfect smiles, different types of plants, filters, etc.

In all these cases, the CPP isn't just a landing page but rather a mini-pitch built around intent. FaceApp has a page that's focused on hairstyles for keywords like "hairstyle try on" and another showing various age filters for keywords like "aging app".

Who Isn't Using CPPs?

Some of the most recognizable names on the App Store don't use CPPs at all. Apps like YouTube, Netflix, Duolingo, Gmail, and ChatGPT all fall into the "none" bucket.

I was a bit surprised at first, but after a quick investigation I found two reasons for that:

- They don't rely on Apple Ads. YouTube, Netflix, and Duolingo don't use Apple Ads at all, and CPPs have only been useful there until now.

- They're category leaders. When your brand is the category, you may not think you need to explain what you do. Again, now that they'll impact organic conversion I bet you those 17 apps will be customizing just as well.

Take Duolingo. A user searching for "learn Spanish" could see a different page than someone searching "practice German." I showed how competitor Babbel's doing that with its CPPs in my last live stream.

Same for ChatGPT. Right now, they only show a single store page whether you're coming from "AI chat," "coding help," or "write a poem." With CPPs, they could align features to each intent and likely drive more installs and higher-quality users.

Developers, whether you're running Apple Ads, focus on ASO, or both, this is your next lever.

I'll have a tutorial for how to set up Custom Product Pages for organic discovery (ASO) out very soon. Make sure you're subscribed to the newsletter to get it when it drops.

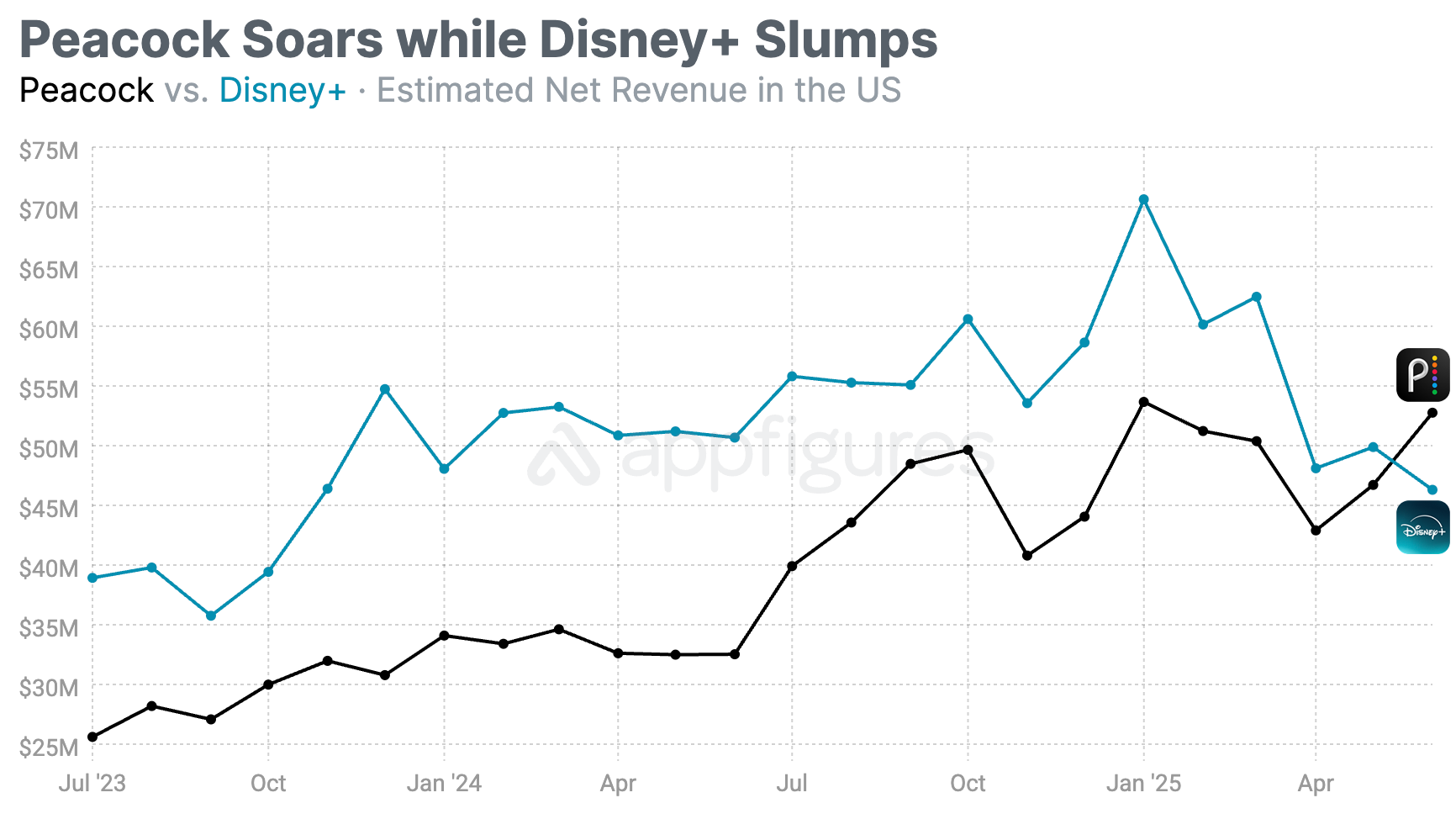

2. Peacock's Mobile Revenue Overtook Disney+ for the First Time

I didn't think I'd see this happen, but it did and I'm here to write about it. Peacock's mobile revenue overtook Disney+'s mobile revenue in the US for the first time ever in June.

Appfigures Intelligence shows Peacock's net revenue, what NBC gets to keep after giving Apple and Google their share, rose to $52.8M in June. That's an all-time high for Peacock. It's also a 62% increase from June of 2024.

That's pretty impressive considering short drama apps have been taking away revenue from traditional streamers at the same time.

In June, that was enough to beat Disney+, which our estimates show hauled just $46M from the US. I say just because Disney+'s revenue has been declining rapidly this year - down 35% since January.

That's Disney+'s lowest month of US revenue since the end of 2023. But it's not lack of demand that's causing this drop. Rather, it's a "strategic" move Disney's made last years to stop taking new in-app subscriptions on the App Store.

Back to Peacock!

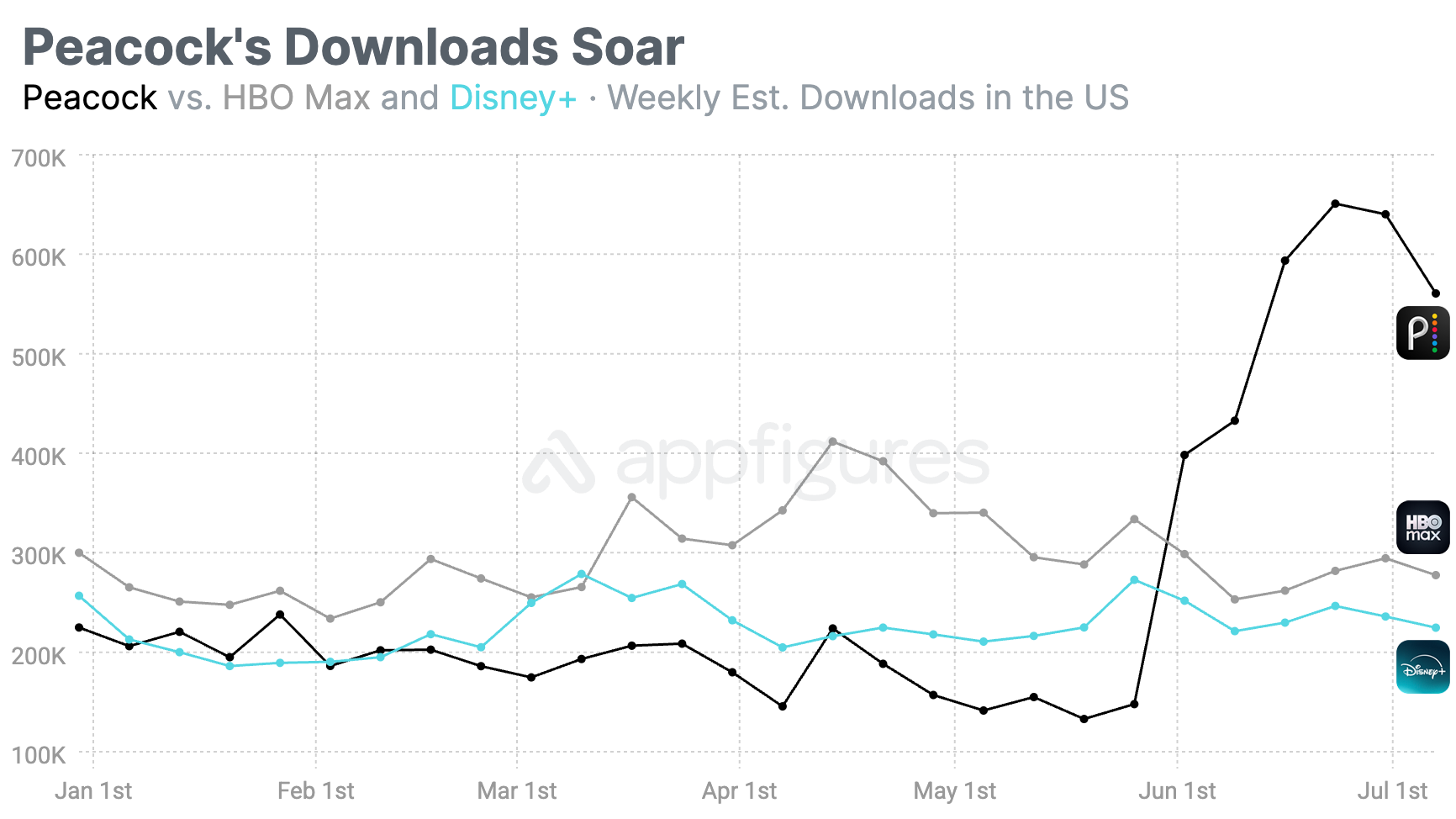

In addition to revenue growth, the app is also seeing a massive growth in downloads. According to our estimates, downloads have tripled since June and far outpace Disney+'s and also HBO Max's.

What's causing this spike? Content. And content is king!

NBC's Love Island, one of the most popular shows this summer, streams on Peacock. And it seems like almost half of its viewers are new.

I expect this trend to slope back down as this season of Love Island (eventually) fades, but it's clear Peacock already figured out the formula and will use it again to give both Disney+ and HBO Max a run for its money.

See Appfigures In Action

Better intelligence to beat the competition faster!

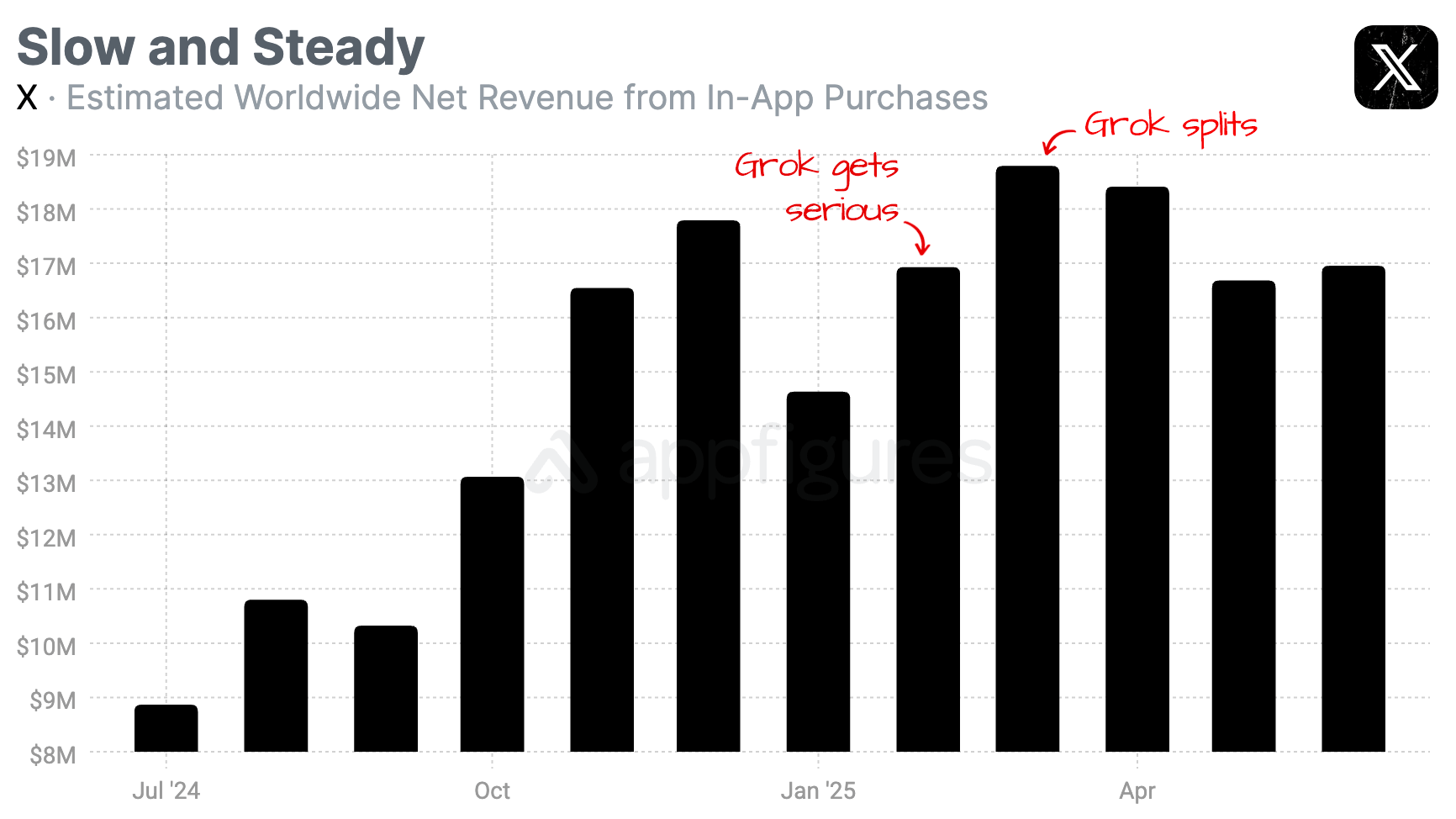

3. Grok Gives and Grok Takes – Checking In on X’s Mobile Revenue

June is behind us which means it's time for my monthly check-in on X’s mobile revenue. The gist: revenue is up a bit, but still under the highs we saw earlier this year.

And I think I know why.

According to Appfigures Intelligence, X ended June with $17M in net revenue from the App Store and Google Play. That's a smidge higher than May's $16.7M, and overall a welcome direction shift after May's slump.

But it's also a good chunk lower than April's $18.8M haul.

A lot has happened this year that could impact X's revenue, so the fluctuations we're seeing aren't all that surprising. But I don't think this is only a matter of politics. Instead, I think it's strategic.

If you've been following my monthly check-ins, you probably remember the spike in revenue that started late last year and carried into Q1. That lift started with price hikes and aggressive promotions, but another component of it was Grok - X's ChatGPT competitor which started getting serious last year.

Grok gave X users a reason to upgrade and many did.

But starting in February, Grok officially became its own app with its own in-app purchases. That shifted revenue growth away from X, and that's why April's revenue slumped. Our App Intelligence shows Grok's net revenue rose from $2.8M in March to $3M in May. Add those back to X's revenue and the story changes.

The other thing, which I mentioned in last month's check-in, is that even after the split, X's mobile revenue is higher when compared to this time last year. That's a good sign for the platform.

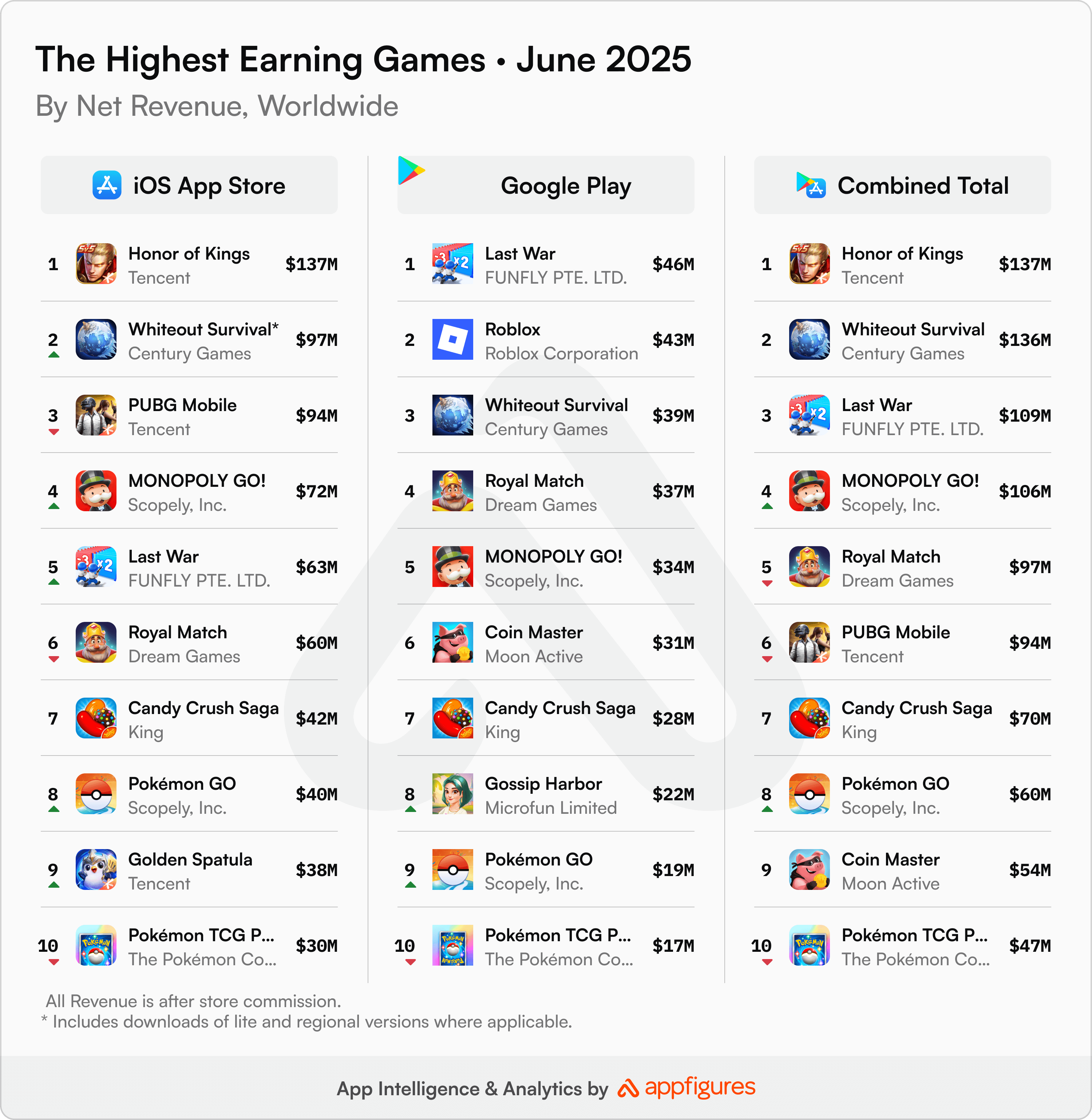

4. A Double Portion of Pokémon - The Highest Earning Games in the World

There's been a disturbance in the eerie calm that's fallen over the top-earning charts as of late, and it has to do with an almost 10 year old game. Let's take a look at what I found in June's data.

Tencent's Honor of Kings is long past becoming the mobile game with the most months at the top of this ranking. They may as well just declare once and for all it's HoK and everything else. That said, the game still hasn't managed to catch on in Western markets, so the spending you're seeing is mostly from China and Southeast Asia.

Appfigures estimates that the game netted $137M last month, which is actually down $17M from May's total.

That dip in revenue meant that last month's #2 performer, Whiteout Survival from Century Games, nearly caught up to it with $136M in estimated net revenue globally. The title, set on an Earth in the grip of a new ice age, was also #2 in May.

Last War also saw its rank unchanged from May, but #4 went to Scopely's Monopoly Go, which rolled the dice and moved up from #6 in May.

PUBG Mobile wasn't able to hold onto its #5 position from May, losing it to Royal Match, which was pushed down the chart during Monopoly Go's ascent. PUBG had pushed Monopoly Go out of the top five in May, showing just how competitive the topmost rankings are.

Pokémon Go hadn't been seen in these charts since March, but it returned to all three last month in the lower half of the rankings. Still, its presence meant there were two Pokémon titles on all three charts, the other being Pokémon TCG Pocket.

$910M was generated by the top 10 games last month, after the store fees were deducted. That was down slightly from $926M for May's top 10 (by only about 2%) but still $12M higher than April's haul of $898M.

Ready to Beat the Competition?

Appfigures has the intelligence you need

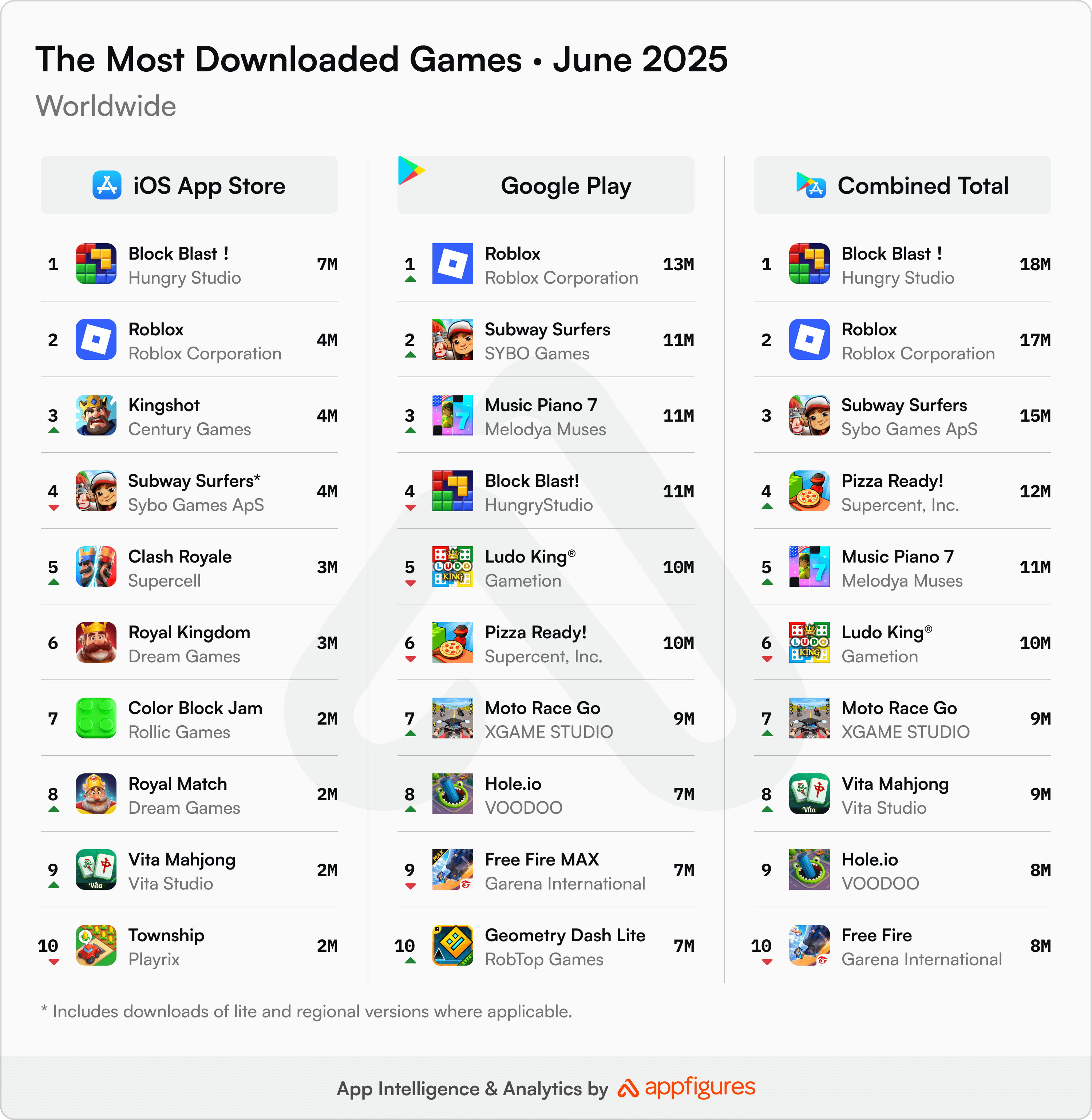

5. Blocks or Blox? That is the Question - The Most Downloaded Games in the World

June's biggest games by downloads were largely the same as in May, with one noteworthy exception. Let's see how they stacked up by looking at the data.

For the third month running, the overall ranking's two highest slots have been all about blocks — and Block Blast has come out on top each time, overtaking Roblox for the crown. That said, when you crunch the numbers, Appfigures estimates show that at 18M for June, Block Blast actually shed 1M downloads compared to its 19M in May.

#2 ranked Roblox, on the other hand, gained 1M downloads over May to reach 17M for the month. That being the case, wasn't it the real winner? We think so.

Rounding out the top five are mostly familiar faces (well, icons, really) with the perma-popular Subway Surfers (#3 overall) featuring across all three charts, joined by Pizza Ready (#4, up one spot from May), but #5 went to newcomer Music Piano 7 with its 11M downloads that pushed Ludo King with its 10M into the lower half of the chart.

Outside the overall top 10, Clash Royale's return deserves recognition. The title hasn't seen the top 10 in ages, but came back swinging on iOS after Supercell seriously reworked it to include an entirely new game mode.

Back to the overall chart, its 10 titles, including the new Moto Race Go at #7, amassed a combined 117M downloads, up 6% from the 110M generated by May's top 10.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.